Automate STR & Airbnb Cleaning

with our Easy-to-Use

Cleaning Service App

No more messy communications with your cleaner & worrying about missing a changeover!

Find out more

In the realm of property rentals, two dominant strategies have emerged, sparking a heated debate on profitability: Airbnb and traditional long-term renting. Landlords and property owners often find themselves weighing these two options, each offering its unique set of advantages and drawbacks. While Airbnb is seen as a modern, flexible approach to property rental, traditional renting is often viewed as a more stable, time-tested method.

Airbnb, a platform for short-term rentals, is known for its potential to yield higher returns, given the right circumstances. The platform’s pricing flexibility allows landlords to adjust rates depending on demand, potentially leading to higher earnings during peak seasons. However, this strategy also requires a more hands-on approach, with landlords needing to manage bookings, clean and maintain the property between guests, and handle potential issues that arise during a guest’s stay.

On the other hand, traditional renting, which involves long-term lease agreements, offers landlords a consistent income stream and less frequent turnover. This method, however, may not yield as high a return as Airbnb, especially during periods of high demand. Additionally, traditional renting provides fewer opportunities for price adjustments, as rental rates are typically fixed for the duration of the lease.

Ultimately, the choice between Airbnb Vs renting will depend on several factors, including the landlord’s financial goals, time commitment, and risk tolerance, as well as the property’s location, condition, and local market conditions. As such, it is essential for landlords to thoroughly research and consider these variables before deciding on the best strategy for their rental property.

Airbnb differs significantly from traditional renting. It offers landlords higher earning potential and flexibility, with no lease agreement and built-in insurance. However, Airbnb also requires more upkeep, has higher expenses, and less stability than traditional renting. For example, Airbnb hosts can adjust their pricing based on demand, enabling them to potentially earn more during peak seasons.

Traditional renting, on the other hand, provides a consistent income, requires less upkeep, and has lower tenant turnover. However, it may offer less earning potential and less flexibility compared to Airbnb. For instance, rental income from traditional leases is steady and predictable, but landlords have less control over pricing adjustments.

The potential income from short-term rentals versus full-time rentals is a crucial factor for hosts and property owners to consider when deciding between Airbnb Vs renting. For instance, Airbnb provides hosts with the flexibility to adjust pricing based on demand, seasonal variations, and local events, enabling them to maximize their income potential. This means that during peak travel seasons or local events, hosts can increase their rental rates to capitalize on the higher demand, ultimately leading to increased earnings.

On the other hand, traditional rentals offer a steady cash flow as per the terms of the lease agreement. This stability can be advantageous for hosts who prefer a predictable and consistent income stream, without the need to constantly adjust prices or manage fluctuating demand. However, it’s important to note that short-term rentals have been experiencing a surge in demand, especially in the wake of the COVID-19 pandemic. This trend suggests that short-term rentals may offer the potential for higher income, particularly in popular tourist destinations or areas with high visitor traffic.

In addition to these considerations, it’s valuable to explore specific case studies that highlight the income potential of short-term rentals. For example, in a city with a thriving events industry, such as music festivals or major sporting events, short-term rental hosts have been able to capitalize on the surge in demand by adjusting their pricing strategies. This has resulted in substantial income gains during these peak periods, showcasing the earning possibilities of short-term rentals. Understanding these specific scenarios can provide hosts with insights into the potential income variations and the impact of local events on rental earnings.

When it comes to upfront and ongoing costs, there are significant differences between Airbnb and traditional rentals. For Airbnb hosts, there are various initial expenses to consider, such as furnishing the property to meet the expectations of short-term guests, installing keyless entry systems, and implementing security features to ensure the safety of guests and their belongings. Additionally, hosts may need to invest in professional photography and marketing to make their property stand out in a competitive market. These upfront costs are essential for attracting guests and maintaining a high occupancy rate, but they can add up quickly and impact the host’s profitability.

Moreover, Airbnb hosts need to account for ongoing expenses such as regular cleaning and maintenance between guest stays, as well as the cost of utilities and amenities provided to each new set of guests. These ongoing expenses can fluctuate significantly, especially during peak seasons when demand is high, leading to increased utility costs and maintenance requirements. In contrast, traditional rentals generally have lower ongoing expenses, as they typically involve longer-term leases with fewer turnovers and less frequent maintenance and utility costs. Landlords of traditional rentals can anticipate a steady stream of rental income, making it easier to budget and plan for ongoing expenses.

For example, in cities with strict regulations and high demand for short-term rentals, hosts may need to allocate a significant portion of their earnings towards compliance costs, such as obtaining the necessary permits and licenses. These additional expenses can impact the overall profitability of hosting through platforms like Airbnb. On the other hand, landlords of traditional rentals may face fewer regulatory hurdles and compliance costs, resulting in more predictable ongoing expenses and a higher proportion of rental income contributing to their bottom line.

Regulations concerning short-term rental units are becoming more stringent, with varying laws governing Airbnb and traditional renting across different states. For example, in cities like New York and San Francisco, there are specific regulations and restrictions on short-term rentals, which may not apply to traditional long-term leasing arrangements. These regulations can include zoning laws, building codes, and occupancy taxes, all of which can significantly impact the feasibility and profitability of hosting through platforms like Airbnb.

Moreover, the tax implications for Airbnb hosting are distinct from those of traditional renting, necessitating careful consideration and professional tax consultation. For instance, income from short-term rentals may be subject to different tax rates or deductions compared to long-term rental income. Understanding and adhering to these tax obligations is critical for hosts to avoid potential penalties or legal complications.

Hosts and property owners need to be well-versed in the legal requirements and implications of both Airbnb hosting and traditional renting to ensure compliance and mitigate the risk of legal issues. By staying informed about the evolving regulatory landscape and seeking professional advice, hosts can make informed decisions and operate within the boundaries of the law, safeguarding their properties and livelihoods.

In addition to these legal considerations, it’s essential to explore specific case studies that illustrate the impact of regulatory changes on hosting decisions. For instance, in cities where short-term rental regulations have been tightened, hosts may need to reevaluate their hosting strategies and consider the potential impact on their rental income. Understanding the experiences of hosts in these locations can provide valuable insights into the practical implications of legal considerations on hosting decisions.

No more messy communications with your cleaner & worrying about missing a changeover!

Find out more

Managing an Airbnb property demands a significant amount of time and effort due to the higher guest turnover. Hosts need to allocate time for various tasks, such as regular cleaning, guest communication, and property maintenance. For instance, after each guest checks out, the property needs to be thoroughly cleaned and prepared for the next guest’s arrival. This involves washing linens, restocking essentials, and ensuring the property is in top condition. Moreover, hosts must be responsive to guest inquiries, requests, and potential issues that may arise during their stay, which can be time-consuming.

On the other hand, traditional renting usually involves less frequent turnover, resulting in fewer management demands for hosts. With long-term tenants, hosts are not required to address turnover-related tasks as frequently as with short-term rentals. This translates to less time spent on property management, allowing hosts to have more predictability and stability in their schedules.

It is crucial for potential hosts to carefully consider the time commitment required for managing a property, as this can significantly impact their daily routines and overall quality of life. For those with limited availability or a preference for minimal involvement in property management, traditional renting may be a more suitable option. However, individuals who are willing to invest the time and effort into managing a property actively may find the flexibility and potential for higher earnings with Airbnb hosting to be advantageous.

In addition to these time management considerations, it’s valuable to delve into specific examples that demonstrate the time commitment required for managing short-term rentals. For instance, in cities with high tourist influxes, Airbnb hosts may need to dedicate a significant amount of time to property maintenance and guest communication during peak seasons. Understanding these specific scenarios can provide potential hosts with a realistic view of the time demands associated with Airbnb hosting.

When it comes to the flexibility with scheduling and income security, Airbnb offers hosts the ability to set flexible pricing based on demand, allowing them to adjust rates to attract more guests during peak seasons and events, ultimately maximizing their income potential. For example, a host with a property in a popular tourist destination may increase the nightly rate during a local festival or a major event, taking advantage of the high demand for accommodations.

On the other hand, traditional renting provides a more stable and predictable income stream due to the fixed lease agreements, offering hosts a sense of security with regular rental payments. For instance, a property owner leasing out a residential property to long-term tenants can expect a consistent monthly income, providing financial stability and predictability.

It’s essential for hosts to consider the implications of these different income structures. While Airbnb allows for flexibility in pricing and the potential to maximize income, it also comes with irregular income, as demand for short-term rentals may fluctuate. In contrast, traditional renting provides a reliable and steady stream of income, offering a level of financial security for hosts. Therefore, hosts should carefully weigh the trade-offs between flexibility and income stability when deciding between Airbnb hosting and traditional renting, taking into account their financial goals and risk tolerance.

In addition to these considerations, it’s valuable to explore specific examples that highlight the income security and flexibility aspects of hosting decisions. For instance, in cities with significant seasonal variations in tourist arrivals, Airbnb hosts may experience fluctuations in income due to changes in demand. Understanding the experiences of hosts in these locations can provide insights into the practical implications of income security and scheduling flexibility on hosting decisions.

When it comes to damage liability and property wear and tear, Airbnb hosting and traditional renting have distinct considerations. For Airbnb hosts, the potential for wear and tear on the property is higher due to the frequent turnover of guests. This increased guest turnover poses a greater risk of damages, prompting hosts to consider obtaining additional vacation rental insurance to protect against these potential risks.

For example, if an Airbnb property experiences a high volume of guests throughout the year, the likelihood of minor damages such as scuffed floors, worn-out furniture, or broken appliances may increase. These damages can accumulate over time, necessitating repairs or replacements and resulting in additional maintenance costs for the host.

On the other hand, in traditional renting, the wear and tear on the property may be less significant due to longer lease terms and fewer occupants over time. With a single tenant or family residing in the property for an extended period, the wear and tear is generally more gradual and predictable, allowing landlords to plan and budget for maintenance and repairs accordingly.

Understanding these implications for property maintenance and potential damages is crucial for hosts and property owners to make informed decisions. By carefully considering the unique wear and tear risks associated with both Airbnb hosting and traditional renting, hosts can take proactive measures to mitigate these risks and protect their investment in the long run.

Additionally, it’s valuable to explore specific examples that illustrate the wear and tear risks associated with short-term rentals. For instance, in cities with high tourist traffic, Airbnb hosts may encounter a higher frequency of property damage due to the turnover of guests. Understanding these specific scenarios can provide property owners with insights into the potential maintenance challenges associated with short-term rentals.

When comparing Airbnb Vs renting, it’s crucial to consider the market, location, and bottom line income potential. The property’s location is a key factor in determining the success of either hosting method. For example, a property located in a popular tourist destination may be more suitable for short-term rentals on platforms like Airbnb due to high demand from travelers. On the other hand, a property in a residential neighborhood may be better suited for traditional long-term renting, offering steady income from reliable tenants.

Moreover, local laws and regulations can significantly impact the feasibility of Airbnb hosting versus traditional renting. Some cities and municipalities have strict zoning laws and regulations that restrict or prohibit short-term rentals. Hosts need to be aware of these legal considerations and ensure compliance with local ordinances to avoid potential legal issues. For instance, in some areas, short-term rentals may require special permits or licenses, making traditional long-term renting a more viable option in certain locations.

Additionally, evaluating the maximum bottom line income potential is essential for hosts and property owners. This involves estimating the potential earnings from both Airbnb hosting and traditional renting based on factors such as occupancy rates, rental prices, and maintenance costs. A comprehensive financial analysis can help hosts make an informed decision about which rental strategy aligns with their income goals and property’s potential.

In conclusion, when weighing the options between Airbnb hosting and traditional renting, hosts should carefully consider the market, location, and bottom line income potential to make a well-informed decision about the most suitable rental strategy for their property and maximize their rental income. Each property presents a unique set of circumstances, and understanding these factors is crucial for success in the competitive rental market.

The decision between Airbnb vs renting is one that requires careful consideration for landlords. This is due to the unique set of variables that must be taken into account. For instance, the physical location of the property can play a pivotal role in determining which rental strategy may yield more profits. In certain popular tourist destinations or in cities where events often take place, an Airbnb setup might attract a higher volume of short-term renters willing to pay premium rates. On the other hand, properties situated in residential neighbourhoods may find a steady stream of income through long-term tenants in traditional renting.

Furthermore, local laws and regulations are important considerations when choosing between Airbnb and traditional renting. Some cities and states have strict regulations against short-term rentals, which could limit the viability of an Airbnb strategy. On the contrary, traditional rentals may be easier to obtain permits for, making it an appealing choice for landlords in certain regions.

Lastly, landlords must also consider their own personal income objectives and financial circumstances. While Airbnb has the potential for higher profits, it also comes with higher upfront and ongoing expenses, irregular income, and more time and effort for successful operation. Traditional renting, though potentially offering lower income, provides more stability and predictability, with less upkeep and lower turnover.

In summary, the more lucrative option between Airbnb vs renting is largely dependent on a variety of factors, from location and local legislation to personal income goals and the condition of the property. It is crucial for landlords to thoroughly examine these aspects and make an informed decision that best aligns with their circumstances and objectives.

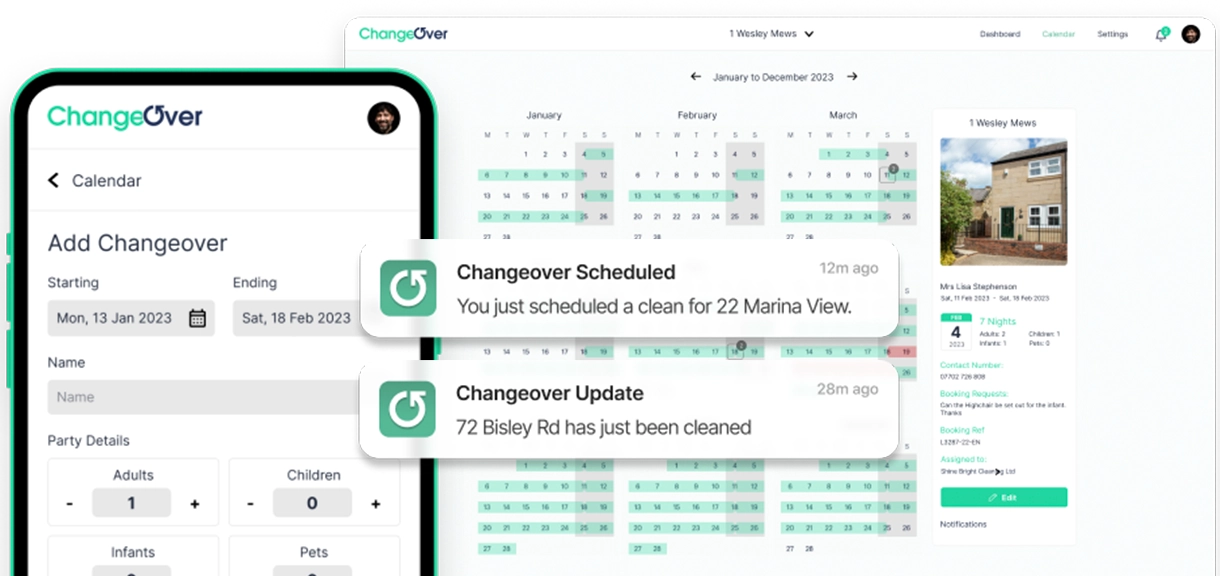

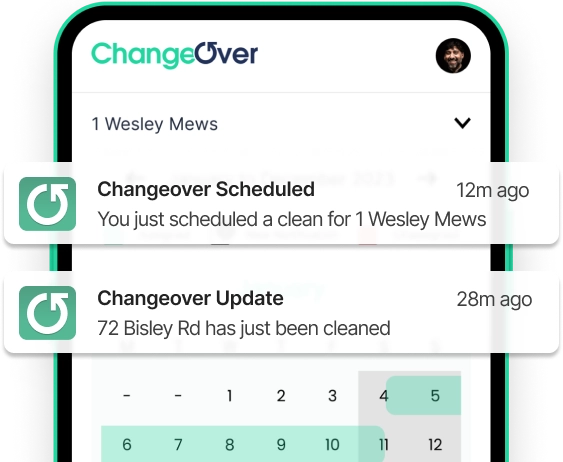

Changeover is a clever platform that shares your booking calendar with your cleaners & then fully automates the scheduling & management of changeovers. Sit back & relax as it tracks progress & sends notifications to ensure that everything is completed smoothly & on time.

Make changeovers simple & stress-free. In a few clicks, you can auto-schedule, share & track cleaning with ease.

Find out more

With more people seeking environmentally friendly options, incorporating sustainable practices into your rental not only benefits the planet, but also...

Read article..Keep in touch & be one of the first to try

Changeover for free!

PS. As a thank you we've put together the ultimate STR & Airbnb cleaning checklist that we'll send you completely free!

Keep in touch & be one of the first to try

Changeover for free!

PS. As a thank you we've put together the ultimate STR & Airbnb cleaning checklist that we'll send you completely free!