Effortlessly automate STR & Airbnb cleaning

Never worry about missing a clean again by ditching those messy spreadsheets, emails & messages.

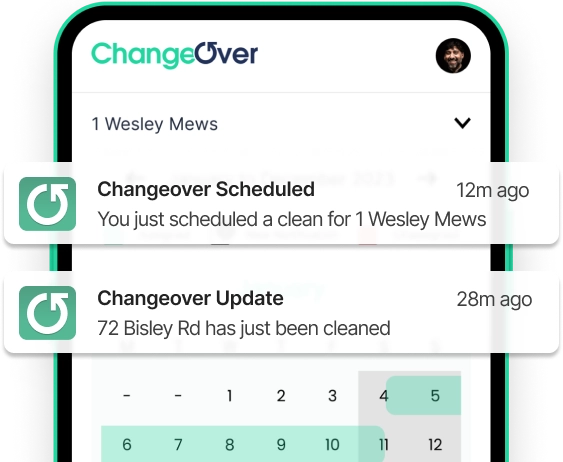

Our clever platform automatically shares, schedules & tracks your changeover from when the booking is first made to the guest’s departure day!

Find out more