Automate STR & Airbnb Cleaning

with our Easy-to-Use

Cleaning Service App

No more messy communications with your cleaner & worrying about missing a changeover!

Find out more

Are you a proud owner of a holiday home? Congratulations! Owning a holiday home can be a dream come true, offering you a cozy retreat whenever you need a break from the hustle and bustle of daily life. But wait, have you thought about protecting your investment with holiday let insurance? If not, you’re in the right place! In this comprehensive guide, we’ll walk you through everything you need to know about holiday let insurance in a friendly and easy-to-understand manner. So, let’s dive in!

Holiday home insurance, also known as holiday let insurance, is a type of insurance specifically designed to protect properties that are used as holiday homes. Unlike standard home insurance policies, which typically cover properties occupied by the owner or long-term tenants, holiday home insurance is tailored to the unique risks associated with short-term rentals.

You might be wondering, “Do I really need holiday let insurance?” The answer is a resounding yes! While your primary residence may be covered by a standard home insurance policy, this won’t adequately protect your holiday home. Holiday let insurance provides essential coverage for risks such as accidental damage, theft, public liability, and loss of rental income, giving you peace of mind knowing that your investment is safeguarded.

When it comes to holiday let insurance, there are several types of coverage to consider. These may include buildings insurance, contents insurance, public liability insurance, and loss of rental income insurance. The specific type of coverage you’ll need depends on various factors, such as the type of property you own, its location, and how often it’s rented out.

Buildings insurance covers the structure of your holiday home against damage caused by events such as fire, flood, storm, or vandalism. It typically includes repairs or rebuilding costs, ensuring that your property can be restored to its former glory in the event of damage.

Contents insurance, on the other hand, protects the belongings inside your holiday home, such as furniture, appliances, and personal items. This coverage is crucial in case of theft, damage, or loss of your possessions, providing financial reimbursement to replace or repair them.

No more messy communications with your cleaner & worrying about missing a changeover!

Find out more

Public liability insurance is essential for holiday let owners as it protects you against claims made by third parties for injury or property damage that occurs on your premises. Whether a guest slips and falls or accidentally damages a neighbor’s property, public liability insurance ensures you’re covered for legal expenses and compensation costs.

Loss of rental income insurance is another vital aspect of holiday let insurance. This coverage reimburses you for lost rental income if your property becomes uninhabitable due to an insured event, such as fire or flood. It provides a financial safety net, allowing you to maintain cash flow even when your property is temporarily out of commission.

Now that you understand the importance of holiday let insurance and the various types of coverage available, you’re probably wondering how to find the best policy for your property. Here are some tips to help you secure the ideal insurance policy:

Don’t settle for the first insurance quote you receive. Take the time to compare multiple insurers and their offerings to ensure you get the best coverage at a competitive price.

Consider the specific needs and risks associated with your holiday home. Do you need additional coverage for high-value items? Are you located in an area prone to natural disasters? Tailor your insurance policy accordingly.

Before committing to a policy, carefully review the terms and conditions to understand what is covered and any exclusions or limitations that may apply. Pay attention to details such as coverage limits, deductibles, and policy extensions.

If navigating the world of insurance feels overwhelming, don’t hesitate to seek advice from insurance brokers or professionals specializing in holiday let insurance. They can offer expert guidance and help you find the most suitable policy for your needs.

In conclusion, holiday let insurance is a crucial investment for any holiday home owner. By protecting your property against unforeseen risks and liabilities, you can enjoy peace of mind knowing that your investment is safeguarded. Whether it’s buildings insurance, contents insurance, public liability insurance, or loss of rental income insurance, there’s a policy out there to suit your needs. So, don’t delay – secure your holiday let insurance today and protect your piece of paradise!

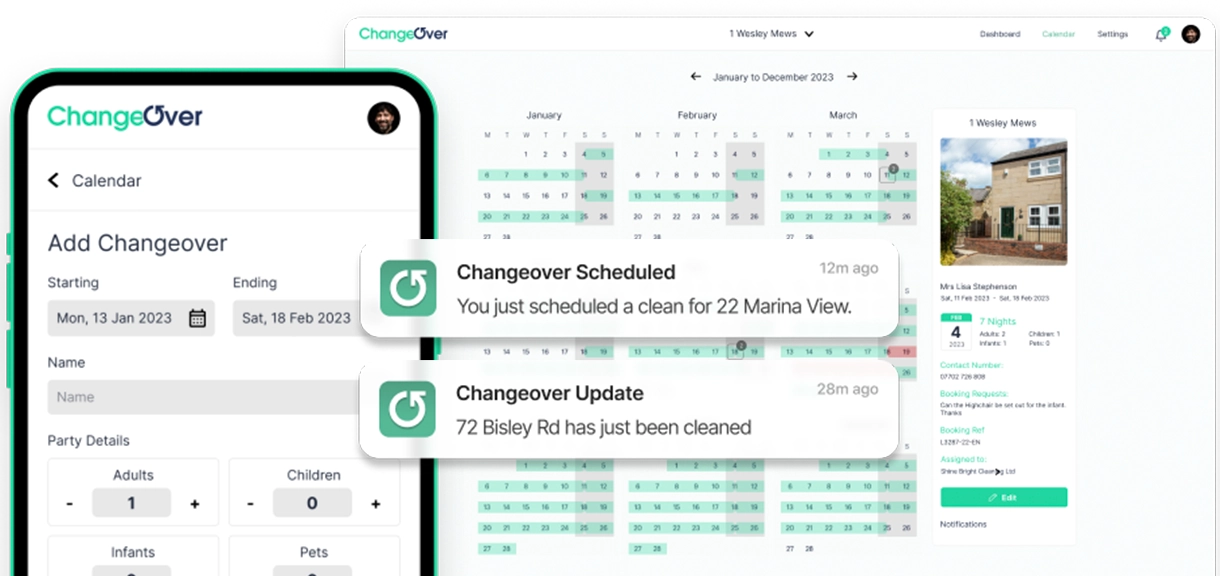

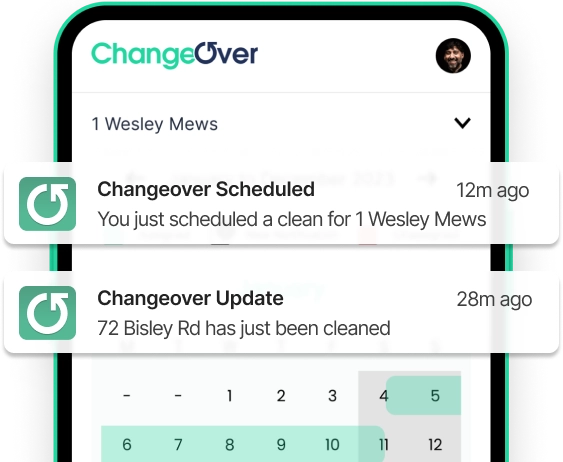

Changeover is a clever platform that shares your booking calendar with your cleaners & then fully automates the scheduling & management of changeovers. Sit back & relax as it tracks progress & sends notifications to ensure that everything is completed smoothly & on time.

Make changeovers simple & stress-free. In a few clicks, you can auto-schedule, share & track cleaning with ease.

Find out more

With more people seeking environmentally friendly options, incorporating sustainable practices into your rental not only benefits the planet, but also...

Read article..Keep in touch & be one of the first to try

Changeover for free!

PS. As a thank you we've put together the ultimate STR & Airbnb cleaning checklist that we'll send you completely free!

Keep in touch & be one of the first to try

Changeover for free!

PS. As a thank you we've put together the ultimate STR & Airbnb cleaning checklist that we'll send you completely free!